Financial Modelling

For Peak Performance

FIlacontexta

Many things in life may appear unconnected at first. It is only on further inspection that they are actually linked. This link may be tenuous, subtle or absolutely fundamental.

FilaContexta (Latin for Connected Threads) is an acknowledgement of this. These threads are crucial to understanding opportunities and maximising their value.

FilaContexta’s business modelling expertise can identify and quantify your business opportunities, so that you can reduce the risk and reap the reward!

Our services

Risk Analysis

Identify and measure the factors that can make or break your business.

Financial Modelling

Build dynamic models of your assets to optimise performance.

Fiscal Analysis

Understand the potential upside for standalone analysis or benchmarking anywhere in the world.

Monte Carlo Simulation

Identify outlier cases and determine their likelihood using probabilistic techniques.

Business Planning

Create a strategy and plan that can stand the test of time.

Decision Analysis

Raise alternate paths and find the logical choice with the best data available.

Our Blog

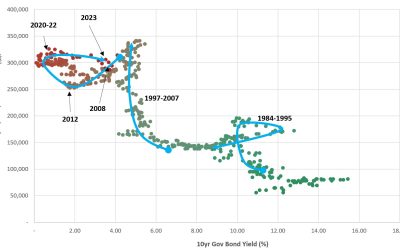

Interest Rates and their impacts…

Interest rates are a strange beast. The average person's relationship with "the interest rate" rarely extends beyond the benefit they get from savings, or the cost of a mortgage. However they can have wide-ranging long term consequences due to their subtle...

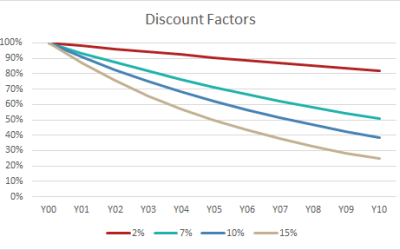

BASICS – How can we measure Rewards?

The principle of Discounted Cash Flow (or DCF) is at the core of quantifying "Reward". It is used to value income and expenditure, taking into account the relative value over time, in a systematic way. Why do it? Nothing in life is free, especially money. Even over...

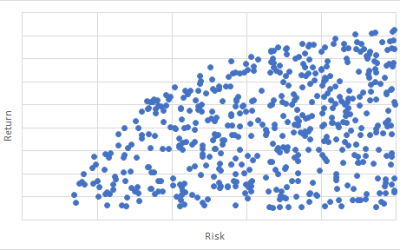

Risk and/or Reward?

If you don’t look at the risk, you’ll do something silly. If you only look at the risk, you probably won’t do anything!