The principle of Discounted Cash Flow (or DCF) is at the core of quantifying “Reward”. It is used to value income and expenditure, taking into account the relative value over time, in a systematic way.

Why do it?

Nothing in life is free, especially money. Even over the last decade, money’s cost – the interest rate – has meant that when you lend money you expect slightly more back.

If you lend someone $100 for a year you can now expect to get back 5% interest, or $105, at the end of that year. The recipient should therefore be making a return of 5% or more in order to justify the loan. By performing a DCF on investment opportunities with a Discount Rate of at least 5% they can ensure that anything with a discounted value >0 should generate value rather than destroy it.

What is the Discount Rate?

So what is the Discount Rate? In short it takes into account Risks (the “%” from the Intro), starting at a bare minimum with inflation and/or interest – the risk that your money is either worth less due to inflation, or can be put to better use in a bank account. From there it will also be uplifted by the likelihood of non-payment (i.e. Credit Risk), any Foreign Exchange risk, etc.

Before you overthink the Discount Rate, what are you trying to get out of it? You just want to make sure it covers your cost of capital (so you don’t actively lose money), but beyond this it simply becomes a hurdle rate to ensure you only pursue projects greater than it.

There’s no hard rule of what is and is not in the Discount Rate, by I find it’s often more insightful to incorporate what you can into the cashflow. Monte Carlo analysis (more on that another day) can be particularly useful in capturing uncertain outcomes without resorting to the coarse approach of the Discount Rate.

How is it calculated?

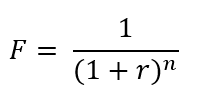

For every year in the expected investment, a Discount Factor (F) can be calculated. This Factor is a function of both the Discount Rate (r) and the number of years away it is (n). Therefore the formula below ties these components together:

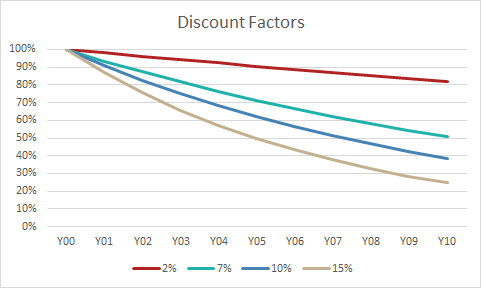

The impact of this factor is shown in the graph below. Higher Discount Rates impact cash flows more than lower ones, and the distant future is impacted more than the near-term.

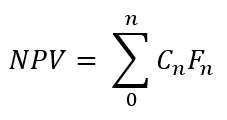

By combining each individual Cashflow (C) with it’s corresponding Discount Factor, you get the Net Present Value, or NPV, of the project.

What does it mean?

So you have done all the steps above and have an NPV.

If it’s > 0, this is good. If it’s < 0, this is not.

There reasons for disappointment in due course can typically be boiled down to 2 things:

- How certain are you of the Cashflow?

- Is the Discount Rate appropriate, throughout the life of the project?