You may enjoy risky leisure activities or seek risky investments, but why? It’s for the reward!

This reward is easier to comprehend, whether it’s the adrenaline rush of staring down a couloir before dropping in, or the multi-bagger returns of some innovative young business. What’s harder is comprehending all the other outcomes, especially the ones that don’t bear thinking about!

Much like Scrooge here, the average punter (or Executive in my experience) prefers to think about the “$” and not at the “%”, but as anyone who’s looked at risking will know, outcomes are most sensitive to the “%”.

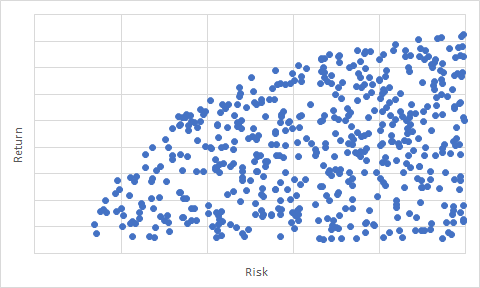

Also, the return of an opportunity is largely dictated by the risk it entails. Risk weighs on the expected return, while also requiring you to chase higher success-case returns in order to justify higher risks.

Therefore it makes sense to plot graphs of Risk and Return as shown in the graph below. Take note, Oil Industry – the typical chart showing PoS (Probability of Success, a measure of risk) on the y-axis and prospect size (a measure of return) on the x-axis should perhaps be swapped.

Such graphs are a fundamental of Modern Portfolio Theory.

If you spend too much time looking at the “$” and not enough looking at the “%”, you may do some silly things.

Then again, if you spend all your time looking at the “%”, you may not do anything at all – sometimes a little risk is a good thing!